Due Diligence

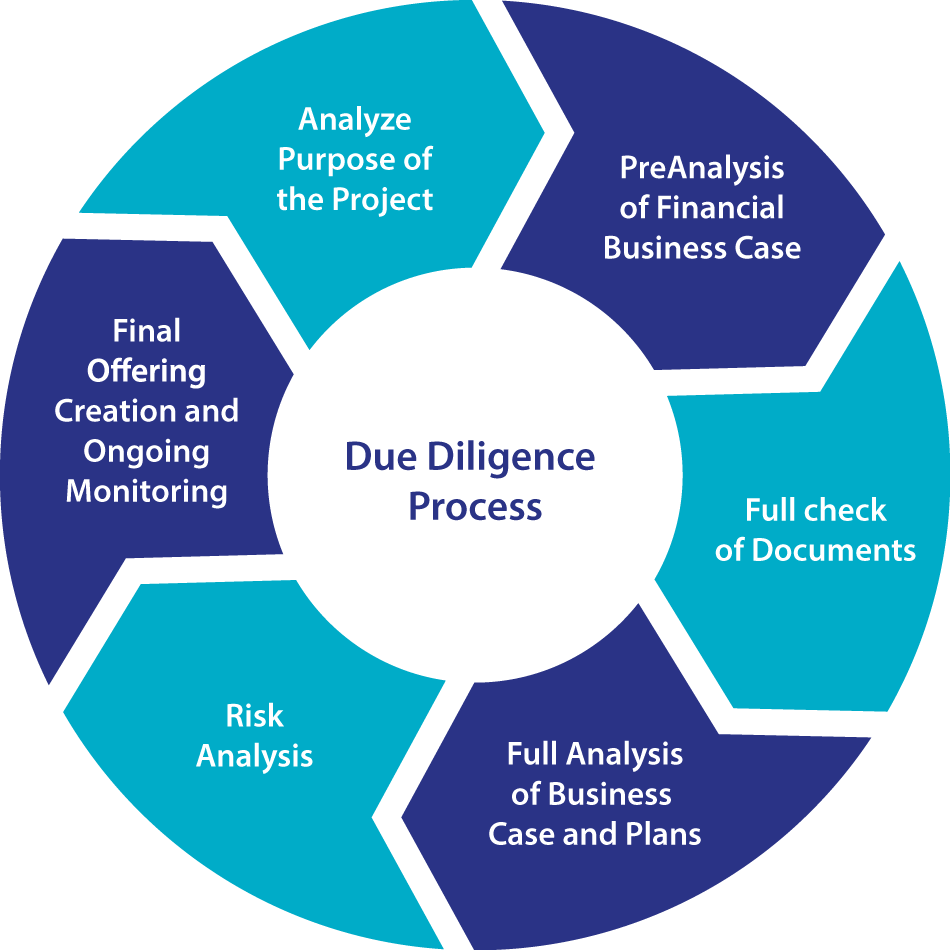

Due Diligence Process

The Due Diligence process is an important part of the Eco System of Realty Africa.

For this process, we are supported by Deloitte as our service provider. The process goes through several process steps.

Process Steps

The Due Diligence methodology is based on the Four Step Analytic process of Fitch Analytics which has been adapted to specically t the ECO System of Realty Africa.

Analyze Purpose of the Project

During this step, the legal structure of the proposed project is analyzed as well as the purpose of funding. The projects facilitated by Realty Africa are typically new developments or projects to refurbish existing buildings.

Pre-Analysis of the Financial Business Case

This pre-analysis is performed by Realty Africa as a rst step to assess if the cash ows make sense and allow room for a suitable payback oer to the investors that represents typical sector and country risk. A total calculation is performed including additional costs that come with attracting funding via our platform.

Full Check of the Documents

A full check of the documents is performed to make sure that the documents are original and not tempered with. The most important document is the Title Deed of the land where the Mortgage Bond will be taken out on. Realty Africa requires that the original title deeds are given into custody with our local law firm.

Full analysis of Business Case and building plans

With the assistance of Deloitte as our service provider, a full due diligence will be conducted on the business and the building plans. The building plans should be sound and complete. The business plan must be comprehensive taking into account the purpose, region, area and surrounding structures as well as competitive businesses.

Risk Analysis

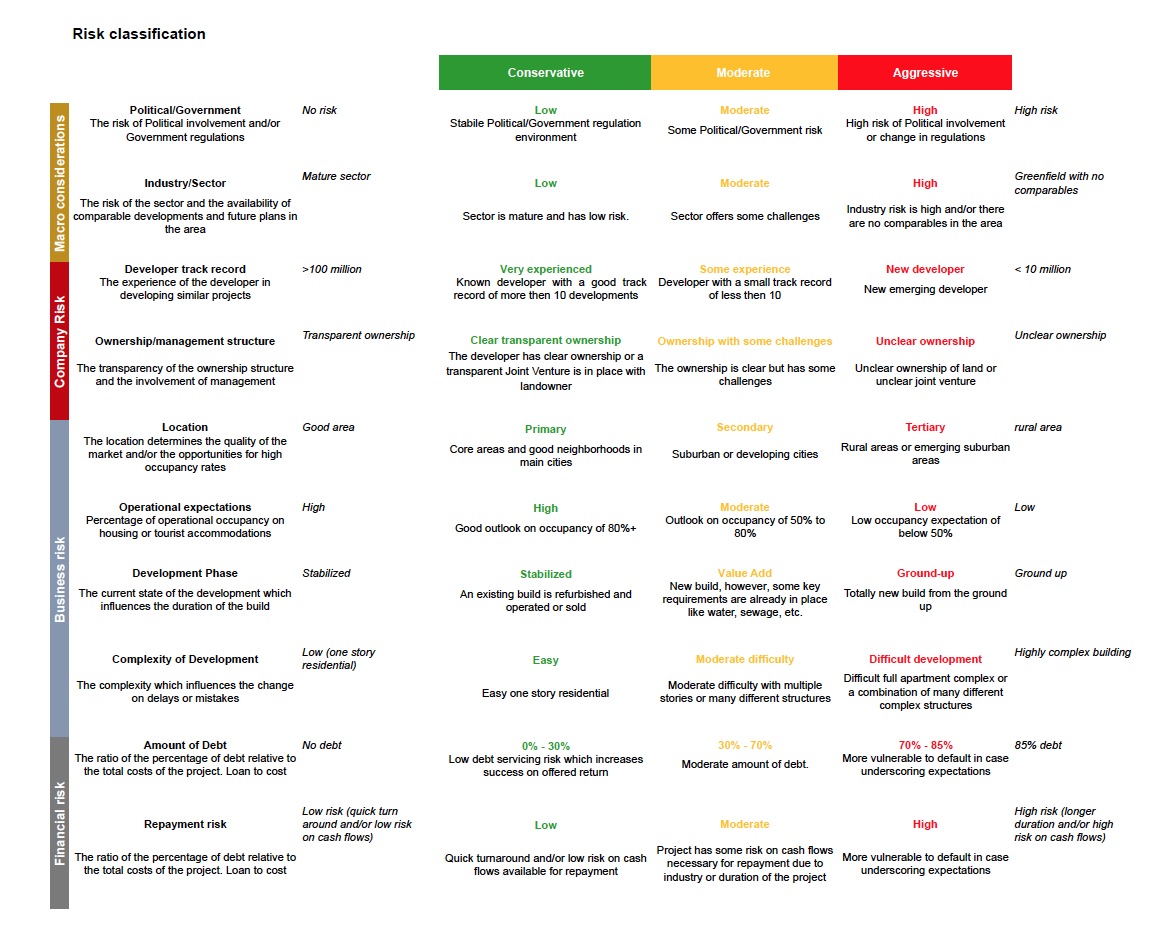

Part of the full analysis is to identify the major risks, specic to the project. The risk analysis focusses on all riskvelements like:

- Macro considerations; country and sector risks

- Company-specic risks; track record and management risk

- Business risks; location, complexity and development risk

- And Financial risks; leverage and repayment risk

See Investor Risks for more information about the risks involved in investing in projects on the platform of Realty Africa.

Final offering and ongoing monitoring

After a successful due diligence process, the final offering is created for the investor. Realty Africa will conduct ongoing monitoring with regular visits to the building site. These visits are also a pre-condition for the release of new funds to the developer. Longer term projects which continue into operations after finishing the development phase, are required to provide periodical reporting. These companies are subsequently monitored for signs of credit deterioration.