Realty Africa ECO System

The Realty Africa ECO-System

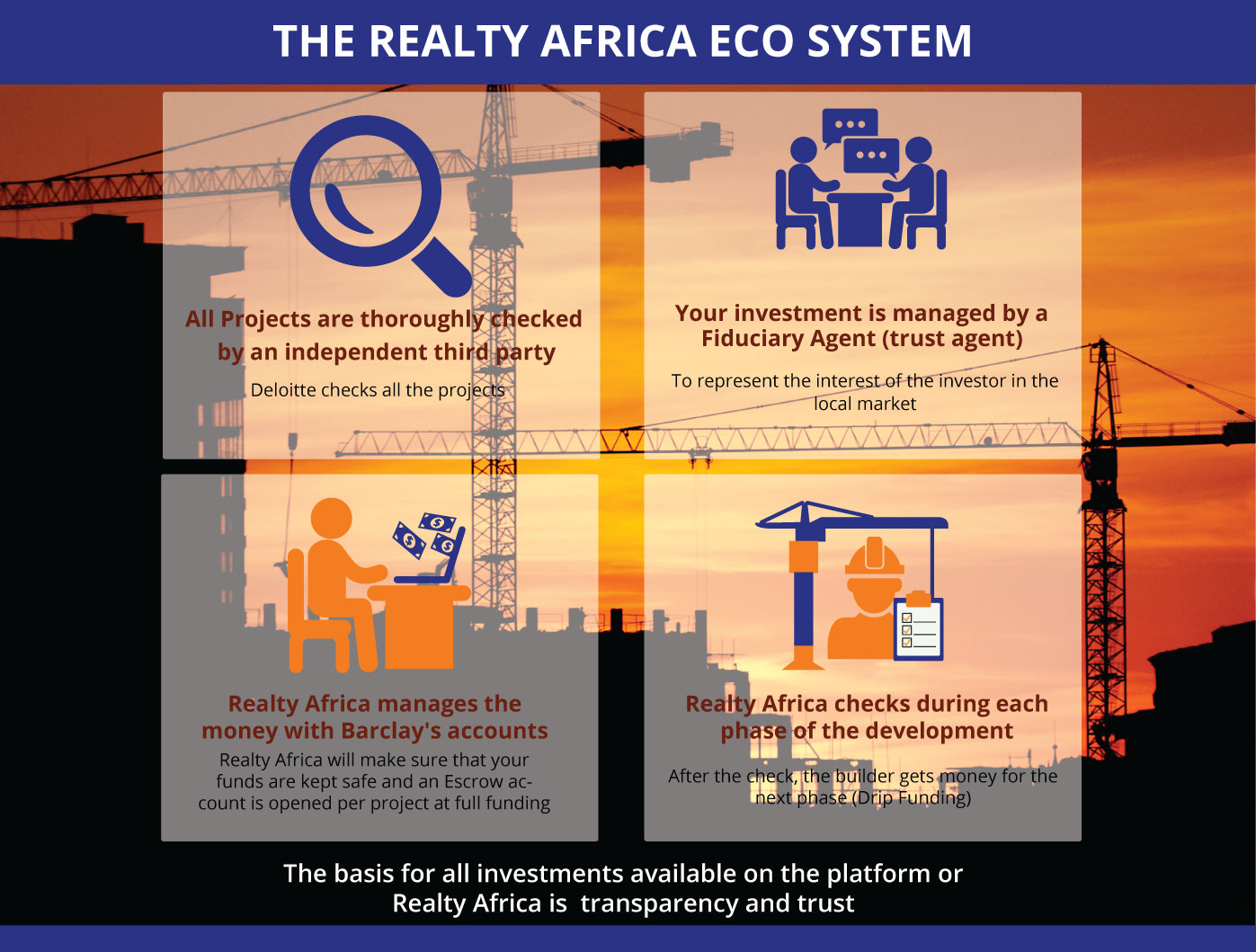

The aim of Realty Africa is to make these investment opportunities available in an easy, trusted and transparent way for private as well as institutional investors, which are less specialised in African investments and are unable to access those investments directly. Realty Africa connects small and large investors with projects from vetted developers on our Property Crowdfunding Platform. We have a strong focus on good project Due Diligence with the assistance of Deloitte as our on the ground service provider, on Investor Protection and the management of Investor Funds.

As facilitators we have created a sound ECO System which includes:

- A sound legal structure with security which has direct recourse on the asset

- A thorough Due Diligence process with involvement of Deloitte

- Trusted bank accounts at Barclay's Bank to hold the funds

- Active Management of the Investor Funds (Drip Financing)

- Use of Fiduciary or Trust Agencies that act on behalf of the Investors S

- Surveyor checks on building project progress

- Full Exit management

Due Diligence

Due to the perception of Africa by some foreign states, a general mistrust of new ventures in Africa by the locals and further a vast amount of schemes in the region, we at Realty Africa want to make sure that we can create the appropriate trust and transparency with our customers.

Therefore, we thought it prudent to bring a renown third party, Deloitte, to perform the due diligence on both the property developer and the project. This gives more comfort to investors to make an informed decision. Other investigations include background checks of fraud, criminal, and credit checks. An assessment of the market conditions, the viability of the project and its bankability will also be considered. See Due Diligence for more detailed information on the due diligence process that is performed on each project.

Trust Structure

Our first concern is to manage the risks of our investors and provide comfort to the developer at the same time. Investing in Real Estate development in Sub-Saharan Africa entails risk (See Investor Risks for an overview of the investor risks). To lower the risk, we created security for our investors with direct recourse to the asset. To manage this collateral on behalf of the investors, we have established a trust structure in each country with a trust agent, which is either a law firm or a local investment firm which also makes sure that your investment is placed completely bankruptcy remote from the Realty Africa Company. This Trust Company will also manage the bailout process in case this is necessary.

Barclays Accounts

We have established our base of operations in Botswana. We are also part of the Botswana Innovation Hub (See BIH Information & Technology Communication Members for more information on the membership of Realty Africa) which is incorporated as a company to develop and operate Botswana’ s first Science and Technology Park. The main goal is to create an environment that supports start-ups and existing local businesses as well as attract international companies and institutions to develop and grow competitive technology driven and knowledge based businesses.

We also incorporate our bank accounts at Barclays Botswana, where our investors can wire their committed amounts. As soon as a project is fully funded and depending on the size of the project, a separate escrow account is established specifically to manage the project payment.

Ongoing Monitoring

It is a priority of Realty Africa to manage the Investor Funds. When investing in a development project, it is important to make sure that the money is well spent and used according to the specifications of the building plans. Realty Africa adopted the method of Drip Funding. During each phase of the project, a thorough onsite check will be performed, before a new batch of funding is disbursed to the developer. Large supplier bills are paid directly. This is the best way to keep track of the money control the funds.

Realty Africa will stay involved until the Investor has an exit and the funds are returned.